Just starting out as a property developer? Beginning to explore development finance? Chances are you’ve come across the term ‘capital stack’.

Deciphering this piece of industry jargon is probably the last thing you want to be doing. No doubt you’re already occupied with the bewildering array of potential lenders on the market, each with their own criteria, risk appetites, and leverage limits.

But understanding the capital stack will help you navigate these options. Once you’ve gotten to grips with this key concept, you’ll be able to ask the right questions. For example:

- Do terms offered by senior debt providers cover enough of your costs?

- What’s better: a high street bank with a lower interest rate or a challenger bank that is faster and more flexible?

- Does needing to put less cash into your deal justify the cost of mezzanine debt?

Asking these and similar questions will help your achieve your business goals, whether you want to maximise profit or reduce your cash commitment.

So, what is the capital stack?

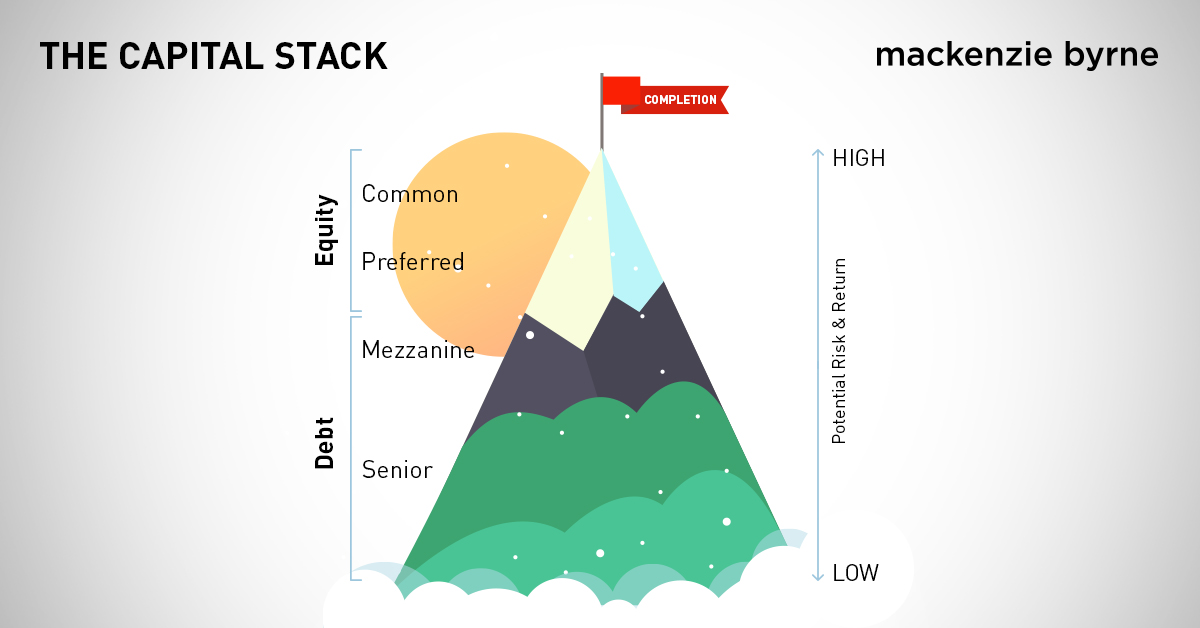

The capital stack is a metaphor for the total capital invested in a development project. At the bottom of the stack you have your senior debt (making up the largest portion of capital) and, in the middle, mezzanine debt. At the top of the stack comes equity, which can be your own funds or investment from a third party.

Each level of the stack comes with different risks for the lender and, therefore, different costs. Understanding how best to structure the capital stack is key to achieving your goals as a property developer.

Let’s take a closer look at each level in turn.

Capital Stack Level 1: Senior Debt

Senior debt is always at the bottom of the stack. It is called ‘senior’ because it commands a first charge against the development site. If you can’t pay back your senior debt lender for whatever reason, they can take possession of your development and sell it to recoup their loan.

Senior debt can be secured from different types of lender, including:

- high street banks

- challenger banks

- private lenders

- peer-to-peer lenders

It’s the cheapest part of the capital stack because it comes with relatively low risk to the lender (thanks to the first charge). It’s also the largest part and can cover up to 80% of project costs.

Senior debt lenders usually charge a combination of arrangement and exit fees (1%-2.5% of the loan) and interest which varies according to leverage. The higher the loan as a percentage of Gross Development Value (GDV), the greater the risk to the lender and, therefore, the higher the interest rate.

A low leverage loan (say 55% Loan-To-GDV) might come with an interest rate of 9% p.a., while higher leverage (70% LTGDV) might come with rates of up to 13%.

Capital Stack Level 2: Mezzanine Debt

The second level of the stack is mezzanine debt (or ‘mezz’).

Mezz is usually secured from specialist providers and can take your borrowing (combined with senior debt) up to either 75% LTGDV or 90% loan-to-cost.

As is the case with senior debt, different providers will have different requirements, costs and maximum leverage limits. It’s important to give yourself the broadest understanding of the options available on the market before choosing a lender.

The interest on mezzanine debt can range between 15% and 25% p.a., making it expensive compared to senior debt. This is due to the greater risk involved for mezz lenders, who only command a second charge.

A second charge leaves mezz lenders subject to the priorities of first charge lenders. If things go wrong, a senior lender might sell a development site to recoup their own loan at a price that doesn’t pay back much (or any) of the mezz loan.

Capital Stack Level 3: Equity

The third and final level of the capital stack is where you will find the equity component. Equity can be your own cash, cash from an investor, or a combination of both. A range of different types of investor provide equity, including:

- high net worth individuals

- family offices

- property funds

Like mezzanine finance, investor equity only commands a second charge. This, combined with the high leverage that it tends to cover (between 90% and 100% of project costs), makes it very risky and expensive.

Often, you’ll be charged interest on investor equity (sometimes referred to as a ‘coupon’) and will then have to share the remaining profit with your investor. This can mean giving away up to 50% of your gross profit.

Another thing worth highlighting is that some senior lenders have a minimum equity commitment from borrowers (usually between 5% and 10% of total project costs), often referred to as ‘skin in the game‘. Essentially, these lenders will want to know that you have some money on the line and won’t walk away if the going gets tough.

If you want to work with such a senior lender and use investor equity at the same time, you may need to make your investor a shareholder in your company. That way, your investor’s equity becomes that of the entity borrowing from the senior lender (i.e. your company) and you can fulfil the ‘skin in the game’ requirement.

How to Structure Your Stack

The combination of senior debt, mezz and equity you use to fund your next development is a formula worth taking the time to consider. Let’s take an example to see how different combinations can affect your profit as a developer. In this scenario, our developer has £400,000 to put to work.

Project 1:

Project GDV – £2,000,000

Project Costs (excluding finance costs) – £1,500,000

Developer Equity available – £400,000

Option 1 – Senior Debt Only

60% Loan-to-GDV = £1,200,000

Total Costs (including cost of debt) – £1,600,000

Developer Equity input = £400,000

Development Profit = £400,000

Option 2 – Senior and Mezzanine (finance costs increase to £150k with introduction of mezzanine)

Senior – 60% Loan-to-GDV = £1,200,000

Mezzanine = £200,000

Total Costs (including costs of debt) = £1,650,000

Developer Equity input = £250,000

Development Profit = £350,000

Here we see a clear difference. The finance combination in option 2 is more expensive and leaves the developer with less profit after completion of the project. So option 1 is the best option, right?

Not so fast.

Option 2 leaves the developer with £150,000 of equity sitting around burning a hole in their pocket while the development is being completed. A smart developer wouldn’t let this opportunity go to waste and would be on the look out for another project to commit this leftover equity to.

Project 2

GDV = £1,000,000

Total Costs excluding finance = £700,000

Total Costs Including Finance = £750,000

Senior Debt 60% Loan-to-GDV = £600,000

Developer Equity = £150,000

Development Profit = £250,000

Development profit after both projects: £350,000 + £250,000 = £600,000

Understanding the capital stack is key to achieving your goals as a developer. Exactly how you decide to approach financing your development projects will depend on the money you have at your disposal, your appetite for growth and your knowledge of the options available to you.

Enjoy this blog? Sign up to Byrne Notice, our fortnightly newsletter for property professionals.